A number of characteristics that affect the intensity of the rivalry among competitors are described below.

High levels of rivalry tend to reduce the profit potential of an industry. Former CEO Ray Kroc allegedly once claimed that “if any of my competitors were drowning, I’d stick a hose in their mouth.” While this sentiment was (hopefully) just a figure of speech, the announcement in March 2011 that Subway had surpassed McDonald’s in terms of numbers of stores might have increased McDonald’s hostility toward its rival.

This is illustrated by a quote from the man who built McDonald’s into a worldwide icon. Subway faces fierce competition within the restaurant business, for example. Because competitors seek to serve the same general set of buyers, rivalry can become intense ( Figure 3.15 “Rivalry”). Competitors use a variety of moves such as advertising, new offerings, and price cuts to try to outmaneuver one another to retain existing buyers and to attract new ones. The competitors in an industry are firms that produce similar products or services.

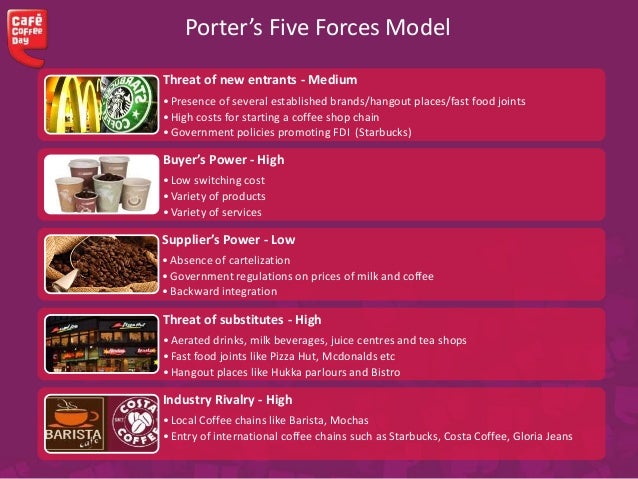

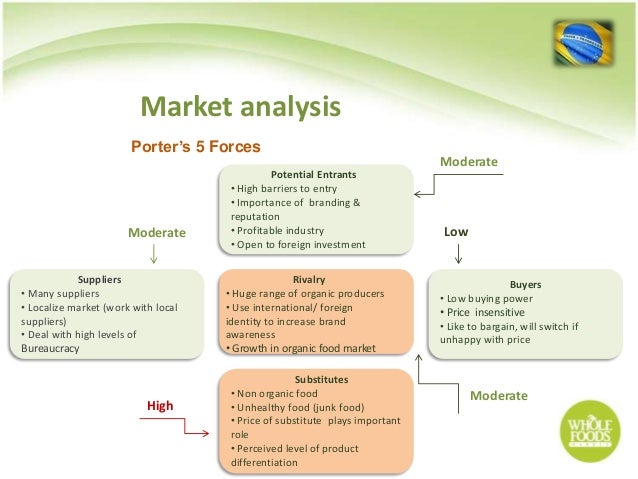

The Rivalry among Competitors in an Industry If the situation looks bleak, for example, one possible move is to exit the industry. Once executives determine how much profit potential exists in an industry, they can then decide what strategic moves to make to be successful. This could involve, for example, all five forces providing firms with modest help or two forces encouraging profits while the other three undermine profits. Most industries lie somewhere in between these extremes. If all the forces work to undermine profits, then the profit potential is very weak. To do so, five forces analysis considers the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers (Porter, 1979). If none of these five forces works to undermine profits in the industry, then the profit potential is very strong. The purpose of five forces analysis is to identify how much profit potential exists in an industry. Introduced more than thirty years ago by Professor Michael Porter of the Harvard Business School, five forces analysis has long been and remains perhaps the most popular analytical tool in the business world ( Figure 3.13 “Industry Analysis”). Visit the executive suite of any company and the chances are very high that the chief executive officer and the vice presidents are relying on five forces analysis to understand their industry. Be able to offer an example of each of the five forces.įigure 3.13: Industry Analysis The Purpose of Five Forces Analysis.Explain how five forces analysis is useful to organizations.

0 kommentar(er)

0 kommentar(er)